Double-entry accounting is the basis of accrual accounting. It is a must-know for beginner accountants but also a concept that becomes ingrained in the mind over time. It might seem foreign at first but once you learn double-entry accounting and apply it in practice then you’ll have an understanding of it. Until then and for all the beginners out there, we’re going to explain double-entry accounting, its definition, how it is applied in practice and the rules of double-entry bookkeeping.

Double Entry Accounting: What is it? [The Definition]

It’s helpful to start with the definition of double-entry accounting. Double-entry accounting is an accounting system that which there is a transaction, it is recorded in at least two accounts, using a corresponding debit and a corresponding credit.

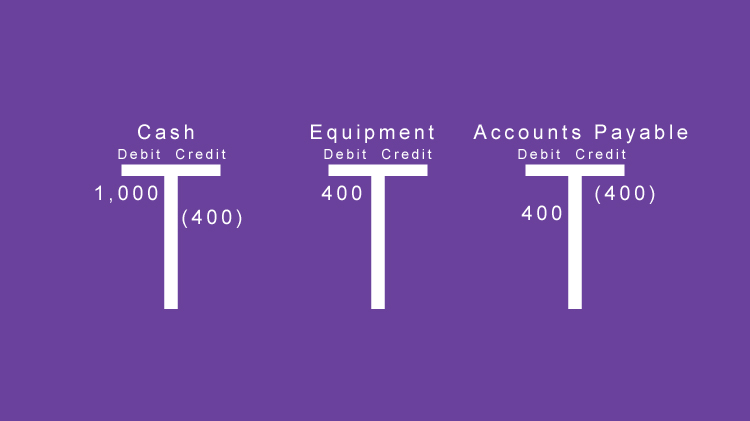

We broke this down visually using our T accounts but we’ll go through another example here as well.

Double Entry Accounting: Rules to Remember

If we break down double-entry accounting from a rules-based perspective, just like Generally Accepted Accounting Principles (“GAAP”) are rules-based, we would see 3 key rules.

- Every transaction needs to hit two separate accounts for double-entry accounting, hence the name double entry.

- Your debits and credits must equal the same amount. That is to say if you debit cash for $500, there needs to be a corresponding credit on the books for $500.

- Stepping back and looking at your accounts, they should be in balance. Your basic accounting equation of asset = liabilities + equity should not be thrown off.

Keep these rules in mind and you won’t be making one-sided entries like cash basis accounting.

Who Uses Double Entry Accounting?

In public and private accounting, double-entry accounting is the most popular used accounting system alongside cash basis accounting. Double-entry accounting is used by any publicly traded company on the stock market and many private companies.

You can’t be an accountant and not know how to explain double-entry accounting because it gets used every day.

Double Entry Accounting Is Used in Practice | Why?

There are two main reasons that double-entry accounting is used by so many companies worldwide. The system has clear transparency of transactions and there is also a balance of accounts.

The general ledger is where all transactions are stored. We have touched on how you can see every transaction in the general ledger in the past. With double-entry accounting, you’ll be able to see the two sides to the transaction (or more) by reviewing the debits and credits.

The general ledger is the place you want to go if you want to trace the two sides of the transactions and not the trial balance. The trial balance is where all of those single transactions roll up into accounts.

So we have established there is a clear transparency of transactions from double entry accounting that you can see in the general ledger but those transactions are also balanced.

Double-entry accounting is balanced in the sense that your assets will always equal your liabilities plus equity. The system keeps the basic accounting equation in check. For every debit, there will be a corresponding credit in the transaction. The total of the debits and credits must be equal for double-entry accounting. Ok, enough of the concepts, let’s see it in action with an example.

Double Entry Accounting: A Beginners Example

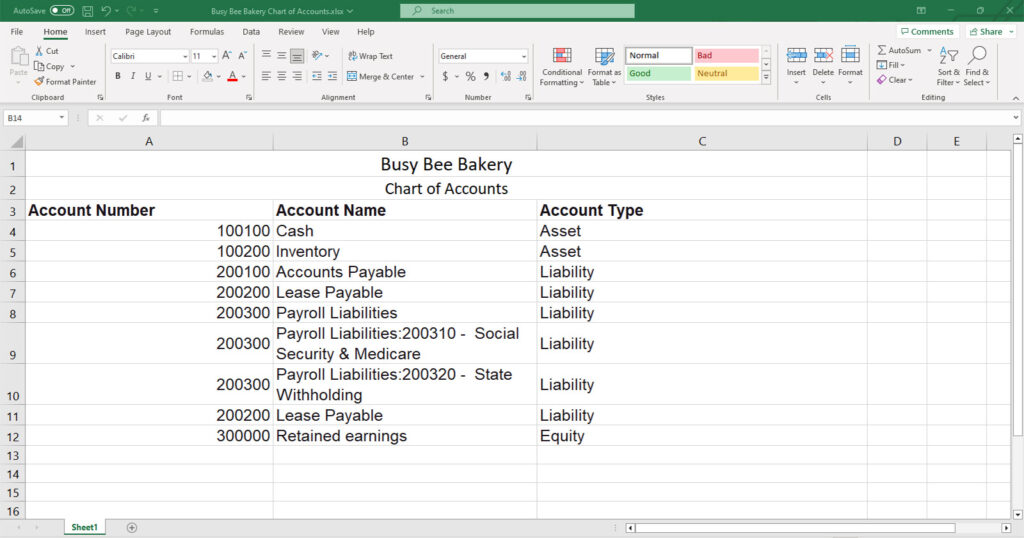

For an example of double-entry accounting, let’s consider Busy Bee Bakery.

The owner of Busy Bee Bakery is setting up his shop and has $1,000 in his cash account. He buys a used oven for $400 on January 5th, on account at a restaurant store which will be delivered at a later date.

Later, the oven is delivered on March 9th. Write down your two entries and then check them below.

For the initial transaction, the bookkeeping staff at Busy Bee will record a debit to equipment for $400. The credit will go to accounts payable for $400 since the oven hasn’t been delivered yet. The key to notice here is that there is offsetting debits and credits for double-entry accounting. The debit to equipment increases assets and the credit to accounts payable increases liabilities.

On the second transaction, when the oven is delivered, we will pay off accounts payable. Credit cash for $400 and debit accounts payable for $400. Again, our accounts stay in balance and we have made a two-sided entry.

A Recap On Double Entry Accounting

At this stage, we have defined double-entry accounting, explained why it is used and even walked through an example. Let’s recap a few of the key points on double-entry accounting.

- There always needs to be at least two entries for double-entry accounting. This is made by having a debit to one account and a credit to another account.

- The debits and credits must equal when you add the sides of the transactions together.

- The basic accounting equation [assets=liabilites+equity] must hold true after making your entry.

- Double-entry accounting is used by all publicly traded companies and many companies worldwide.

- Double-entry accounting is compliant with Generally Accepted Accounting Principles (“GAAP”)

F.A.Q. on Double Entry Accounting

How is Double Entry Accounting Different from Single Entry Accounting?

Double-entry accounting always has a debit to one account and a credit to a separate account. Single-entry accounting only adjusts the cash account for transactions and therefore is one-sided accounting. Single-entry accounting is known as the cash basis.

Who Started Double Entry Accounting and When?

The father of accounting is none other than Luca Pacioli. Double-entry accounting first dates back to 1494 when the first documentation was known to be recorded. It is still being used 500+ years later!

Final Thoughts on Double Entry Accounting

Double-entry accounting is a must-know for accountants. It doesn’t matter if you are a beginner, intermediate or expert. Once you get past the beginner stages of learning accounting skills, double-entry accounting will stick with you. It may seem challenging at first but once you get a handle on your debit and credits, as well as your accounts then you’ll be a master of double-entry accounting.