Two types of accounting that new accountants will come across are single-entry bookkeeping and double-entry bookkeeping. Often these are referred to as single-entry accounting and double-entry accounting as well. We’re going to compare and contrast single-entry bookkeeping versus double-entry bookkeeping, looking at their similarities and differences. Let’s get started with single entry.

What is Single Entry Bookkeeping and Accounting?

Single-entry bookkeeping is pretty much what is referred to as cash accounting. We’ve touched on cash accounting before, but essentially it is accounting for the cash, inflows and outflows, generally from a bank account.

For example, you might add $500 going into a bank account if you sold some goods. You’re running total will increase by $500.

Imagine at the end of the month you need to pay an Internet bill for $75. You would deduct the $75 from the running balance.

Since you are taking the revenues and expenses against a single source, this is what is referred to as single-entry bookkeeping.

When is it used?

A lot of small businesses use single-entry bookkeeping. Not only is it cost-effective for small businesses, but it is also easy to implement. Generally, you’ll see businesses from the small to medium size range using single-entry accounting. For larger companies, it is impractical to you, single entry bookkeeping, and will touch more on that in just a moment.

How Does Single Entry Bookkeeping Work?

As we mentioned, single-entry bookkeeping is unique because there is only one side to the transaction. You are either adding or subtracting to a balance account.

Another example of single-entry bookkeeping may look like the following:

Suppose you are an auto mechanic and complete a car repair job for $250. Imagine your business bank account had a starting balance of $3000.

In your spreadsheet, you are going to a customer payment for $250 and add this to the $3000 balance account. It is that simple.

Single-entry bookkeeping is so simple that it takes most people less than a day to comprehend. Double-entry bookkeeping is quite a bit more complex. Let’s touch on that!

What is Double Entry Bookkeeping and Accounting?

Double entry bookkeeping or accounting as it is more formally known as the standard for most major accounting frameworks. All public companies use double-entry accounting.

So what is the stark difference between single-entry bookkeeping a double-entry accounting? It lies in the number of entries made for a transaction. In double-entry accounting, there are always two or more accounts affected by any transaction. This is completely different from single-entry bookkeeping.

Read More:

What is the Matching Principle in Accounting? [Explained]

When is it Used?

Aside from being used in every publicly traded company, many small companies also use double-entry bookkeeping. It is truly the professional standard for accounting.

Generally accepted accounting principles are based on double-entry accounting. Even international standards are based on double-entry accounting as well.

How Does Double Entry Accounting Work?

Double-entry accounting is quite a bit different from single-entry accounting. As we mentioned, there are always two or more accounts affected in an entry. Every time there is an entry, the debits and credits balance in the entry.

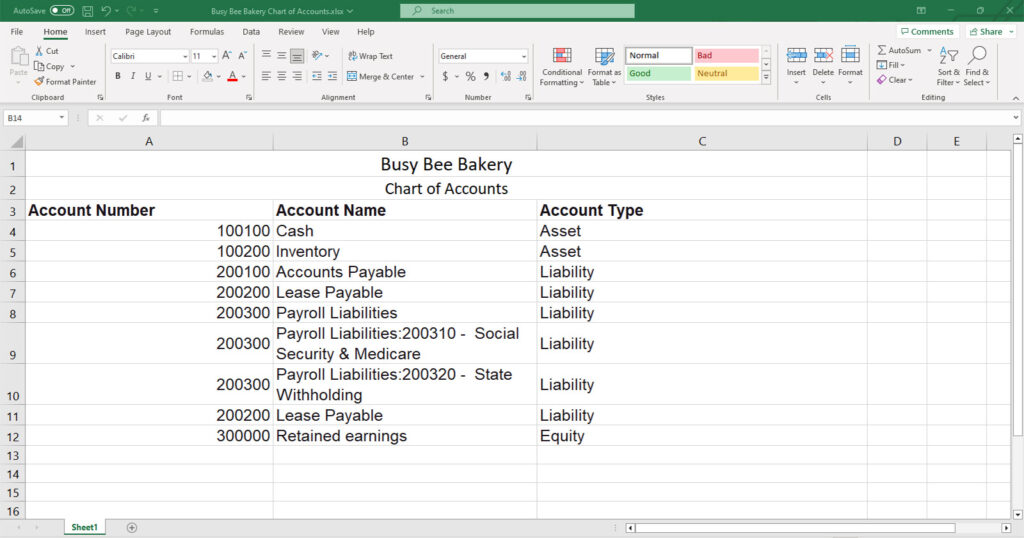

Imagine you run a bakery and need to purchase a new kitchen mixer. You purchase the new mixer for $1000 on account on January 31.

At the date of your purchase, you would debit purchases for $1000 and credit accounts payable for $1000. Here you can see that the entry balances and two accounts were hit. A debit and credit.

A month later you pay off your accounts payable. The entry is then a debit to accounts payable for $1000 and a credit to cash for $1000. Again, in the second example, you’ll see that we hit two accounts as this is double-entry accounting.

While this is a simple example, but clearly illustrates how double-entry accounting is different and more descriptive than single-entry bookkeeping. We go into more complex examples of double-entry accounting in different posts but for now, we will continue on and look at the key differences between single and double-entry accounting.

Read More:

Do Accountants do Bookkeeping? The Not Ideal Truth

Key Differences Between Single and Double-Entry Accounting

| Single Entry Bookkeeping/ Accounting | Double Entry Accounting |

| Simple | More complex |

| Best for small business entities | A must for medium and large companies |

| Cash basis accounting | Accural accounting |

| Can be harder to follow transactions | Easier to trace transactions |

| Much less skill required | Requires training or knowledgeable accountants |

| Lower cost | Higher cost |

Single Entry vs Double Entry Bookkeeping/ Accounting: Which is Better?

So, which is better of the two? Frankly, for most small businesses, single-entry bookkeeping will get the job done. It will be cheaper, faster, and less of a headache if you don’t have any accounting experience.

That said, most accounting software is used double-entry accounting. Even if you don’t see it and they have simplified it for you.

Double-entry accounting should be the framework that you strive for if you want to keep professional books and records. Just keep in mind that even if you choose double-entry accounting, it doesn’t automatically mean that it is compliant with GAAP. Rather double-entry accounting is just a piece of GAAP and International Financial Reporting Standards.

Single Entry vs Double Entry Bookkeeping: Final Thoughts

Single-entry and double-entry accounting/bookkeeping both have their uses in business. While single-entry accounting is used by many businesses, double-entry accounting has been, remains to be and will continue to be the professional accountants’ choice into the foreseeable future. Get in touch if you are starting a business and are stuck between single-entry or double-entry accounting, but hopefully, the above explanation and scenarios have solved it for you.