Financial statements are the accountant’s bible. Due to the amount of information that can be found within financial statements, every company and business professional should know how to read financial statements and understand them.

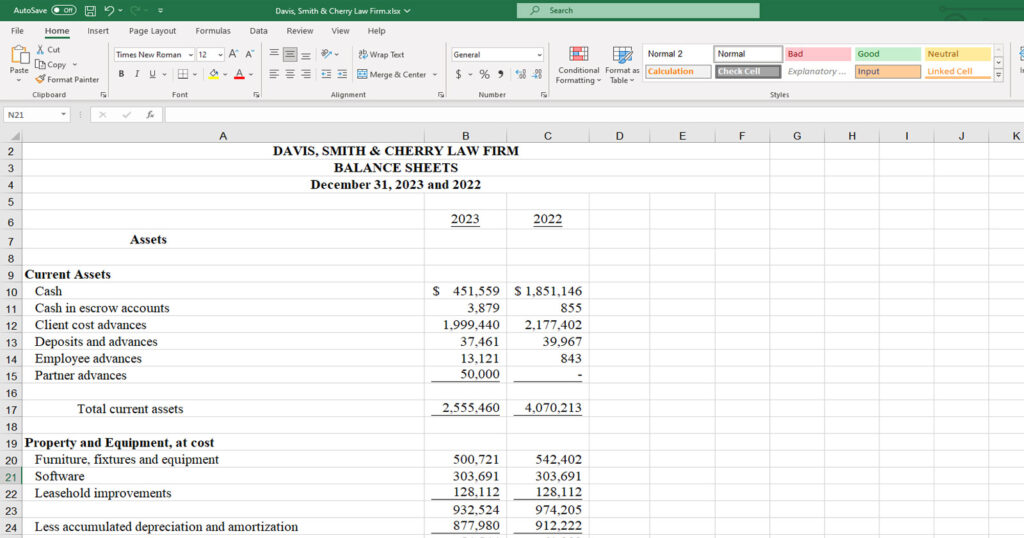

One of the most important and interesting reports included in the financial statements is the balance sheet. It gives a good insight into the financial position of a company at a certain point in time.

Below, we will dig a little deeper into the balance sheet, we will provide explanations on what it is, how it works and what’s in the balance sheet.

Balance Sheet: Explained

In accounting, the balance sheet is considered one of the main reports included in the financial statements, along with the income statement and the cash flow statement. On the balance sheet, we can find information about the assets, liabilities and shareholder’s equity of a company.

Unlike the income statement and the cash flow statement where the information is presented for a period of time, the balance sheet presents the data at a precise date in time. With the assets, you can see what a company owns and with the liabilities, you can see what a company owes.

The balance sheet also gives insight into the amounts that belong to the shareholders and how much they have invested in a company.

For finance professionals, a balance sheet is a good source of information with data points that allows for an analysis of a company’s health using various ratios. Examples of those ratios are the solvency ratio, working capital or debt-to-equity ratio, just to name a few.

Read More:

Income Statement in Accounting: What You Need to Know

Balance Sheet: How Does It Work?

The balance sheet gets its name because it needs to balance. An important formula to remember about the balance sheet :

ASSETS = LIABILITIES + SHAREHOLDER’S EQUITY

As mentioned, assets are what a company owns, liabilities are what a company owes and shareholder’s equity is what belongs to investors. The logic behind the formula is that everything the company owns can be used to cover its liabilities and shareholder’s equity.

Another way to see it would be that any liabilities (external funding) and shareholder’s equity (investor funding) are used to fund the assets owned by the company.

Balance Sheet: What’s In It?

We learned the fundamental formula behind the balance sheet. Now let’s take a deeper look into what’s in the balance sheet. Specifically, what assets, liabilities and shareholder’s equity are made of.

Keep in mind that there are differences in what’s included in the assets and liabilities between different industries but we will lay out the most popular elements.

The assets section of the balance sheet is split between the current assets and non-current assets.

Current assets: anything that can be liquidated and converted to cash in less than 12 months.

- Cash and cash equivalents: this includes cash at the bank or anything that can be converted into cash very quickly, such as certificates of deposit.

- Accounts receivable: this is the amount of money the company is waiting to collect from its customers for sales where the company has extended credit as payment option.

- Inventory: this is the specific goods that are waiting to be sold to customers.

- Marketable securities: this includes any investments made by the company that is highly liquid and can be easily sold in markets for cash.

- Prepaid expenses: this represents goods or services the company paid for but hasn’t received yet, such as an annual insurance contract.

- Other assets: any items that can be converted to cash in less than 12 months but cannot be classified in other current asset categories can be included in other assets.

Read More:

Allowance for Bad Debt: A Deep Dive to Understand Bad Debt

Non-current assets: anything that will take more than 12 months to be liquidated into cash.

- Fixed assets: this includes equipment, buildings or land owned by the company.

- Intangible assets: this includes any assets that are not physical such as licenses, goodwill or intellectual property.

- Long-term investments: this includes any investments that a company does not intend to liquidate within the next 12 months.

The liabilities section of the balance sheet is split between the current liabilities and non-current liabilities, just like the assets section.

Current liabilities: anything owed by a company that needs to be paid within 12 months.

- Accounts payable: this includes any services received by the company or operational debt on invoices that need to be paid within 12 months.

- Salaries payable: this includes the amount of money owed to employees for their labor.

- Current portion of long-term debt: this includes the portion of any long-term debt that is due within 12 months.

- Interest payable: this includes the interest on a long-term debt payable within 12 months.

Non-current liabilities: anything owed by the company that can be settled in more than 12 months’ time.

- Long-term debt: this includes debt obligations that are due in more than 12 months.

- Deferred tax liability: this includes the accrued taxes that are due in more than 12 months.

The shareholder’s equity section is the amount belonging to the investors after all the liabilities have been settled using the assets of the company. This section includes:

- Retained earnings: this includes the net earnings of a company accumulated over the years that can be either retained in the company and reinvested or distributed to investors via dividends.

- Stocks: this is often presented as common stock or preferred stock, which is how investors hold their shares in the company.

Recap of The Balance Sheet and Final Thoughts

The balance sheet paints a great picture of a company’s financial health at a specific date in time. It includes the assets, liabilities and shareholder’s equity of a company. To make it work, a balance sheet needs to have its assets equal to the liabilities plus shareholder’s equity.

Although specific balance sheet accounts can differ from different industries, they will all have current and non-current assets, current and non-current liabilities and shareholder’s equity.

A balance sheet is overall an important tool for finance professionals to evaluate the performance of an entity.